UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| |

Filed by the Registrant ý |

| |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

| | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Section 240.14a-12Under Rule 14a-12 |

FirstCash, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | | |

| Payment of Filing Fee (Check the appropriate box): |

| | | | |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | | (1) | Title of each class of securities to which transaction applies: |

| | | (2) | Aggregate number of securities to which transaction applies: |

| | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | Proposed maximum aggregate value of transaction: |

| | | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | Amount Previously Paid: |

| | | (2) | Form, Schedule or Registration Statement No.: |

| | | (3) | Filing Party: |

| | | (4) | Date Filed: |

To the Stockholders of FirstCash, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders to be held at the Company’s corporate offices located at 1600 West 7th Street, Fort Worth, Texas 76102 at 10:00 a.m. CDT on Thursday, June 4, 2020.

The purpose of the meeting is (i) to elect a class of directors to serve a three-year term beginning in 2020, (ii) to vote on the ratification of the selection of RSM US LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2020, and (iii) to vote on a non-binding resolution to approve the compensation of the Company’s named executive officers.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow the Company to furnish proxy materials to stockholders on the internet. These rules allow us to provide our stockholders with the information they need, while reducing the environmental impact of our Annual Meeting and lowering costs. Unless you previously requested a paper copy of our proxy materials, you will receive a Notice Regarding the Availability of Proxy Materials which tells you how to access the materials on the internet.

Whether or not you plan to attend the Annual Meeting, please vote by internet or telephone at your earliest convenience or complete and return your proxy card if you requested a paper copy of our materials. You may choose to attend the meeting and personally cast your votes even if you fill out and return a proxy card.

We hope that you will be able to join us at the FirstCash Annual Meeting on June 4.

|

| |

| Fort Worth, Texas | Rick L. Wessel |

| April 24, 2020 | Vice-Chairman of the Board and Chief Executive Officer |

FirstCash, Inc.

1600 West 7th Street

Fort Worth, Texas 76102

_______________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 8, 20174, 2020

To Our Stockholders:

We cordially invite you to attend theThe Annual Meeting of Stockholders of FirstCash, Inc. (the “Company”). Our 2017 Annual Meeting will be held at the Company’s corporate offices located at 1600 West 7th Street, Fort Worth, Texas 76102 at 10:00 a.m. CDT on Thursday, June 8, 20174, 2020.*,

The Annual Meeting is called for the following purposes:

|

| | |

| | 1. | To elect Messrs. Daniel E. Berce, Mikel D. Faulkner and Randel G. Owen as directors of the Company;Company for a three-year term beginning in 2020; |

| | | |

| | 2. | To ratify the selection of RSM US LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2017;2020; |

| | | |

| | 3. | To vote on a non-binding resolution to approve the compensation of the Company’s named executive officers; |

| | | |

| | 4. | To vote on a non-binding recommendation regarding the frequency of advisory votes (whether every one, two or three years) on executive compensation; and |

| | |

| 5. | To transact such other business as may properly come before the meeting. |

You should read with care the attached Proxy Statement, which contains detailed information about these proposals. As in previous years, the Company will furnish proxy materials to its stockholders primarily through the Internet. The Company will mail a Notice of Internet Availability of Proxy Materials (“Notice”) to most of its stockholders, which will contain instructions on how to access proxy materials on the Internet and vote. The Notice will also describe how to request a paper copy of proxy materials or electronic delivery of materials via e-mail, free of charge. Stockholders who have previously elected delivery of the Company’s proxy materials electronically will receive an e-mail with instructions on how to access these materials electronically. Stockholders who have previously elected to receive a paper copy of the Company’s proxy materials will receive a full paper set of these materials by mail.

Common stockholders of record at the close of business on April 17, 201713, 2020 will be entitled to notice of and to vote at the meeting.Annual Meeting.

Your voteImportant Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to be held on June 4, 2020:

The Proxy Statement and the 2019 Annual Report to Stockholders are available

at the Company’s website and can be accessed at www.firstcash.com, where a link to the Annual Report on Form 10-K is important, and accordingly, we urge you to complete the on-line voting procedures as described

available on the proxy cardInvestor Relations page of the website (investors.firstcash.com).

PLEASE USE INTERNET OR TELEPHONE VOTING OR COMPLETE AND RETURN A PROXY CARD SO THAT YOUR SHARES WILL BE REPRESENTED AT THE ANNUAL MEETING. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND PERSONALLY CAST YOUR VOTES AT THE ANNUAL MEETING.

* As part of the Company’s precautions regarding the coronavirus or you can sign, date and returnCOVID-19, the proxy card inCompany is planning for the enclosed postage-paid envelope. The factpossibility that you have voted on-line or returned your proxy in advance will in no way affect your right to vote in person should you attend the meeting. However, by signing and returning the proxy, you have assured representation of your shares at the Annual Meeting may be held by means of Stockholders.remote communication only (i.e., a virtual meeting). If the Company takes this step, or if the time, date or place of the Annual Meeting will be changing, the Company will announce the decision to do so in advance, and details on how to participate will be available on the Investor Relations page of the Company’s website (investors.firstcash.com).

We hope that you will be able to join us on June 8.

|

| |

| | Very truly yours,By Order of the Board of Directors, |

|

| |

| Fort Worth, Texas | Rick L. WesselR. Douglas Orr |

April 28, 201724, 2020 | Vice-Chairman of the BoardExecutive Vice President, Chief Financial Officer, Treasurer and Chief Executive OfficerSecretary |

TABLE OF CONTENTS

FirstCash, Inc.

1600 West 7th Street

Fort Worth, Texas 76102

_______________

PROXY STATEMENT

for

Annual Meeting of Stockholders

_______________

GENERAL INFORMATION

This Proxy Statement is being furnished to stockholders in connection with the solicitation of proxies by the Board of Directors (“Board of Directors”) of FirstCash, Inc., a Delaware corporation (the(“FirstCash” or the “Company”), for use at the 20172020 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the Company’s corporate offices located at 1600 West 7th Street, Fort Worth, Texas 7610276102* at 10:00 a.m. CDT, on Thursday, June 8, 2017,4, 2020, and at any adjournments thereof, for the purpose of considering and voting upon the matters set forth in the accompanying Notice of Annual Meeting of Stockholders.Stockholders (the “Notice”). The Company is mailing a printed copy of this Proxy Statement, a proxy card and the 20162019 Annual Report of the Company to certain of its registered stockholders who have not consented to electronic delivery of their proxy materials on or about April 28, 201724, 2020, and a Notice of Internet Availability to all other stockholders on or about April 28, 2017.24, 2020.

The close of business on April 17, 201713, 2020 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of the record date, there were 48,302,19241,440,498 shares of the Company’s common stock, par value $.01 per share (“Common Stock”), issued and outstanding. The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock on the record date is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes (described below) will be counted as present for the purposes of determining the presence of a quorum.

If your shares are held in the name of a broker, bank or other nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street name.” You are not the “record holder” of such shares. If this is the case, this proxy statementProxy Statement has been forwarded to you by your broker, bank or other nominee. As the beneficial holder, you generally have the right to direct your broker, bank or other nominee as to how to vote your shares by providing them with voting instructions.

If you do not provide voting instructions to your broker, bank or other nominee, the voting of your shares by the bank, broker or other nominee is governed by the rules of the New York Stock Exchange (the “NYSE”Nasdaq Global Select Market (“Nasdaq”). These rules allow banks, brokers and other nominees to vote shares in their discretion on “routine” matters for which the “beneficial holder” does not provide voting instructions. On matters considered “non-routine,” banks, brokers and other nominees may not vote shares without your instruction. Shares that banks and brokers are not authorized to vote are referred to as “broker non-votes.”

If you do not instruct your bank, brokerage firm or other nominee in accordance with their directions how to vote your shares prior to the date of the Annual Meeting, your bank, brokerage firm or other nominee cannot vote your shares on the following proposals: “Proposal 1 - Election of Directors,”Directors” and “Proposal 3 - Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers,” or “Proposal 4 - Advisory Vote on Frequency of Advisory Votes on Executive Compensation,” and such shares will be considered “broker non-votes” and will not affect the outcome of these votes. However, your bank or brokerage firm may vote your shares in its discretion on “Proposal 2 - Ratification of Independent Registered Public Accounting Firm.”

* As part of the Company’s precautions regarding the coronavirus or COVID-19, the Company is planning for the possibility that the Annual Meeting may be held by means of remote communication only (i.e., a virtual meeting). If the Company takes this step, or if the time, date or place of the Annual Meeting will be changing, the Company will announce the decision to do so in advance, and details on how to participate will be available on the Investor Relations page of the Company’s website (investors.firstcash.com).

Each share of Common Stock is entitled to one vote on all questions requiring a stockholder vote at the Annual Meeting. The votes required to act on each proposal at the Annual Meeting are summarized below.

Proposal 1 — Election of Directors. A plurality of the votes of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the approval of the election of directors under Proposal 1 as set forth in the accompanying Notice of Annual Meeting of Stockholders. Stockholders may not cumulate their votes in the election of directors. Abstentions and broker non-votes will have no effect in determining whether the proposal has been approved. The election of directors is also subject to the Company’s Director Election (Majority Voting) Policy, which is described below in the “Corporate Governance and Board Matters” section of this Proxy Statement.

Proposal 2 — Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the ratification of the selection of the Company’s independent public accountants under Proposal 2 as set forth in the accompanying Notice of Annual Meeting of Stockholders. Since this proposal is considered a routine matter, brokers will be permitted to vote instructed shares without instruction as to this proposal, and there will be no broker non-votes with respect to this proposal. Abstentions will have the same effect as votes against Proposal 2.

Proposal 3 — Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers. The non-binding resolution to approve the compensation of the Company’s named executive officers will be approved if a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is voted in favor of the proposal. Broker non-votes will have no effect in determining whether the proposal has been approved. Abstentions will have the same effect as votes against Proposal 3.

Proposal 4 — Advisory Vote on Frequency of Advisory Votes on Executive Compensation. With respect to Proposal 4, the frequency option (whether every one, two or three years) receiving the most affirmative votes of all the votes cast in person or by proxy at the Annual Meeting will be the one deemed approved by the stockholders. Abstentions and broker non-votes will have no effect in determining whether any frequency option in the proposal has been approved.

Stockholder Proposals. If any stockholder proposal is properly presented at the Annual Meeting, the stockholder proposal will be approved if it receives the affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting. Broker non-votes will not be counted as having been entitled to vote on such a proposal, and will have no effect on the outcome of the vote on the proposal. Abstentions will have the same effect as votes against any stockholder proposal.

If you are a stockholder of record, you may vote in person at the Annual Meeting or by proxy without attending the Annual Meeting. You may vote by mail by signing, dating and returning your proxy card in the enclosed prepaid envelope. You may also vote over the Internetinternet or by telephone. The proxy card the Company mails you will instruct you on how to vote over the Internetinternet or by telephone. If you hold your shares in an account through a broker, bank or other nominee in “street name,” you should complete, sign and date the voting instruction card that your broker, bank or nominee provides to you or as your broker or nominee otherwise instructs.

Attendance at the Annual Meeting will be limited to stockholders of the Company as of the record date (or their authorized representatives). If you wish to attend the Annual Meeting in person, you will need to present a valid government-issued photo identification, such as a driver’s license or passport. Beneficial stockholders holding their shares through a broker, bank or other nominee in “street name” will need to bring proof of beneficial ownership as of the record date, such as a recent brokerage account statement, the voting instruction card provided by their broker, bank or other nominee or similar evidence of ownership. Stockholders of record will be verified against an official list available at the registration area. The Company reserves the right to deny admission to anyone who cannot show sufficient proof of stock ownership as of the record date.

All shares represented by properly executed proxies, unless such proxies previously have been revoked, will be voted at the Annual Meeting in accordance with the directions on the proxies. If no direction is indicated, the shares will be voted to:in accordance with the recommendation of the Board of Directors as follows: (i) TO ELECT MESSRS. DANIEL E. BERCE, MIKEL D. FAULKNER AND RANDEL G. OWEN AS DIRECTORS; (ii) TO RATIFY THE SELECTION OF RSM US LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2017;2020; AND (iii) TO APPROVE THE ADVISORY PROPOSAL ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS; (iv) APPROVE THE ADVISORY PROPOSAL THAT AN ADVISORY VOTE ON EXECUTIVE COMPENSATION OCCUR ANNUALLY; AND (v) TRANSACT SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.OFFICERS. The designated proxies will vote in their discretion on any other matter that may properly come before the Annual Meeting. At this time, the Company is unaware of any matters, other than as set forth above, that may properly come before the Annual Meeting. The enclosed proxy, even though executed and returned, may be revoked at any time prior to the voting of the proxy (a)(i) by the execution and submission of a revised proxy, (b)(ii) by written notice to the Corporate Secretary of the Company or (c)(iii) by voting in person at the Annual Meeting.

COMPANY OVERVIEW AND ANNUAL REPORT

Company Overview

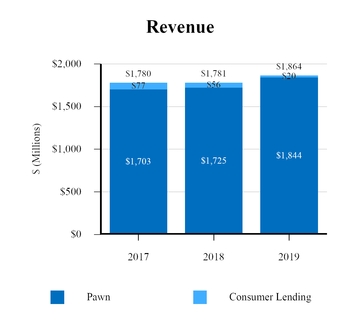

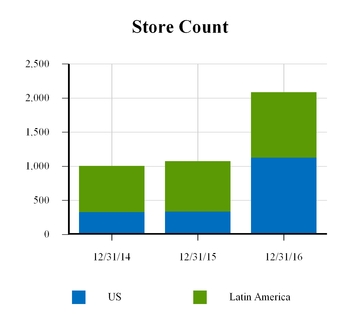

FirstCash is a leading operator of retail-based pawn stores in the United States and Latin America. As of March 31, 2017,2020, the Company had 2,0902,740 retail locations, consisting of 1,1241,052 stores across 26in the U.S. states, 920, 1,608 stores across 32 states in Mexico, 3355 stores in Guatemala, and 13 stores in El Salvador.Salvador and 12 stores in Colombia. The Company has over 16,200approximately 20,000 employees, including approximately 8,000 employees located in the U.S. and 8,20012,000 located in Latin America.

The Company’s primary business is the operation of full-service pawn stores, also known as “pawnshops,” which make small cash advances, known as pawn loans, which are secured by personal property such as consumerjewelry, electronics, jewelry, power tools, household appliances, sporting goods and musical instruments. ThesePawn loans can be quickly and easily accessed by customers who often have limited access to traditional credit products. Pawn stores also retail value-priced consumer products acquired from forfeited pawn stores generate significant retail salescollateral and direct purchases of such merchandise from the merchandise acquired through collateral forfeitures and over-the-counter purchases from customers. In addition, somegeneral public. For the year ended December 31, 2019, 99% of the Company’s revenues were derived from pawn operations. The Company’s long-term business plan is to grow revenues and income by opening new (“de novo”) retail pawn locations, acquiring existing pawn stores offer small unsecured consumer loans or credit services products. The Company’s strategy is to focus on growing its full-service pawn operations in the United Statesstrategic markets and Latin America through new store openings and strategic acquisitions.

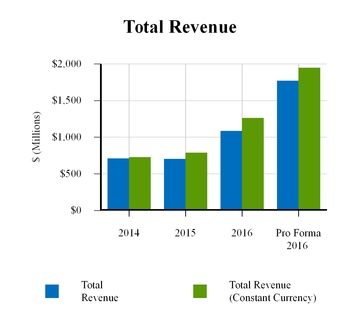

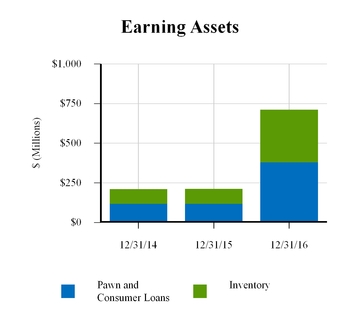

On September 1, 2016, the Company completed a stock-for-stock merger of equals (the “Merger”) with Cash America International, Inc. (“Cash America”). In conjunction with the closing of the Merger, the Company changed its name to FirstCash, Inc. and transferred the listing of its common stock from the NASDAQ Global Select Market to the New York Stock Exchange (“NYSE”) under the ticker symbol “FCFS.” The headquarters of the combined company was moved to the former Cash America headquarters in Fort Worth, Texas.

Under the terms of the Merger Agreement, each former share of Cash America common stock issued and outstanding immediately prior to September 1, 2016 was converted to 0.84 shares of the Company’s common stock. As a result, the Company issued approximately 20,181,000 shares of its common stock to former holders of Cash America common stock. Immediately following the Merger, the Company’s stockholders owned approximately 58% of the common stock of the Company, and the former Cash America stockholders owned approximately 42%.

The Merger created the largest combined retail pawn store operator in Latin America and the U.S., with over 2,000 locations across four countries. This was a transformational transaction for the Company that significantly increased the Company’s revenues, earning assetsincreasing revenue and operating profits and saw the Company’s market capitalization increase to over $2 billion. The combined company provides significant scale and a unified platform for leadership in the pawn industry while keeping the strong local presence and established brands from both companies.existing stores.

Annual Report

The Annual Report on Form 10-K, covering the Company’s fiscal year ended December 31, 20162019, including audited financial statements, is enclosed herewith. The Annual Report on Form 10-K does not form any part of the material for solicitation of proxies.

The Company’s primary website can be accessed atis www.firstcash.com, where a link to the Annual Report on Form 10-K is available on the Investor Relations page of the website (ir.firstcash.cominvestors.firstcash.com). The Company will provide, without charge, a printed copy of its Annual Report on Form 10-K upon written request to R. Douglas Orr, Chief Financial Officer,the Corporate Secretary, at 1600 West 7th Street, Fort Worth, Texas 76102. The Company will provide exhibits to its Annual Report on Form 10-K, upon payment of the reasonable expenses incurred by the Company in furnishing such exhibits.

PROPOSAL 1

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board of Directors will determine the number of directors but shall consist of at least one director and no more than 15 directors. The stockholders of the Company elect the directors. At each annual meeting of the stockholders of the Company, successors of the class of directors whose term expires at the annual meeting will be elected for a three-year term. Any director elected to fill a vacancy or newly created directorship resulting from an increase in the authorized number of directors shall hold office for a term that shall coincide with the remaining term of that class. In no case will a decrease in the number of directors shorten the term of any incumbent director. Any vacancy on the Board of Directors, however resulting, may be filled by a majority of the directors then in office, even if less than a quorum, or by a sole remaining director.

The stockholders will elect threeBoard of Directors currently consists of six directors forfollowing the coming year for termsretirement of three years.Amb. Jorge Montaño from the Board on June 11, 2019. The Board recognizes that it could benefit from the addition of another well-qualified, independent director, and specifically, a female director. As a result, the Board is in the process of identifying a well-qualified, independent female director to serve on the Board and is committed to appointing a female director to the Board no later than the 2021 Annual Meeting.

Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted for the election of the nominees listed herein. Although the Board of Directors does not contemplate that the nomineenominees will be unable to serve, if such a situation arises prior to the Annual Meeting, the person named in the enclosed proxy will vote for the election of such other person as may be nominated by the Board of Directors.

During 2016, theThe Company increased the size of its board from four directors to a total of sevencurrently has six directors, of which fivefour are independent. The current directors are as follows:

|

| | | | | | |

| Name | | Age | | Principal Occupation | | Independence Status* |

| Daniel R. Feehan | 66 | 69 | | Chairman of the Board, FirstCash, Inc. | | Employee |

| Rick L. Wessel | 58 | 61 | | Vice-Chairman of the Board and CEO, FirstCash, Inc. | | Employee |

| Daniel E. Berce | 63 | 66 | | President and CEO, General Motors Financial Company, Inc. | | Independent Director |

| Mikel D. Faulkner | 67 | 70 | | Former Executive Chairman, of the Board, Global Energy DevelopmentNautilus Marine Services PLC | | Lead Independent Director |

| James H. Graves | 68 | 71 | | Managing Director and Partner, Erwin, Graves & Associates, LP | Independent Director |

Jorge Montaño | 71 | Partner, Guerra Castellanos y Asociados

| Independent Director |

| Randel G. Owen | 58 | 61 | | President of Ambulatory Services, Envision Healthcare Corporationand CEO, Global Medical Response | | Independent Director |

*The Board of Directors has determined that, with the exception of Mr. Wessel and Mr. Feehan, all of its directors, including all of the members of the Audit, Compensation, and Nominating and Corporate Governance Committees, are “independent” as defined by the NYSE and the Securities and Exchange Commission (“SEC”) and for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

| |

| * | The Board of Directors has determined that, with the exception of Mr. Wessel and Mr. Feehan, all of its directors, including all of the members of the Audit, Compensation, and Nominating and Corporate Governance Committees, are “independent” as defined by Nasdaq, the Securities and Exchange Commission (“SEC”) and the Company’s Corporate Governance Guidelines. |

Biographical information for the directors is as follows:

Daniel R. Feehan has served as a directorchairman of the Board of Directors of FirstCash since the Merger2016 merger of equals (the “Merger”) with Cash America International, Inc. (“Cash America”) and previously served as a Cash America director since 1984. Mr. Feehan was Cash America’s executive chairman since November 1, 2015 until the completion of the Merger with Cash America.Merger. Prior to that, Mr. Feehan served as Cash America’s chief executive officer and president from February 2000 through May 2015 and as Cash America’s chief executive officer from May 2015 through October 2015, when he retired.retired from that position. Mr. Feehan served as Cash America’s president and chief operating officer from January 1990 until February 2000, except that he served as chairman and co-chief executive officer of one of Cash America’s subsidiaries from February 1998 to February 1999 before returning to the position of Cash America’s president and chief operating officer. Mr. Feehan became a Cash America director in 1984 and joined Cash America full-time in 1988, serving as its chief financial officer before becoming president and chief operating officer in 1990. Mr. Feehan currently serves as a directorthe chairman at AZZ Inc., a NYSE listed equipment manufacturing company, and Enova International, Inc., an online lending company that was spun off from Cash America in 2014 and is listed on the NYSE, where he has served since 2000 and 2011, respectively. Mr. Feehan previously served as a director at RadioShack Corporation from 2003 through 2015 and Calloway's Nurseries Inc., a multi-store garden center chain, from 1999 to 2016.

Rick L. Wessel has served as vice-chairman of the Board of Directors of the Company since September 2016, as chief executive officer since November 2006 and has been a director since November 1992. HeMr. Wessel previously served as president from May 1998 to September 2016, chairman of the board from October 2010 to September 2016, vice chairmanvice-chairman of the board from November 2004 to October 2010 and secretary and treasurer of the Company from May 1992 to November 2006 and the Company’s chief financial officer from May 1992 to December 2002. Prior to February 1992, Mr. Wessel was employed by Price Waterhouse LLP for approximately nine years.

Daniel E. Berce has served as a director of FirstCash since the Merger in 2016 and previously served as a Cash America director since 2006. Mr. Berce has been president and chief executive officer of General Motors Financial Company, Inc. (formerly AmeriCredit Corp.) since its acquisition by General Motors Company in October 2010. Mr. Berce served as AmeriCredit Corp.’s chief executive officer from August 2005 to October 2010, president from April 2003 to October 2010 and vice chairmanvice-chairman and chief financial officer from November 1996 until April 2003. He served as a director at AmeriCredit Corp. from November 1990 to October 2010. Mr. Berce currently serves as a director at AZZ Inc., a NYSE listed equipment manufacturing company, and chairman at Arlington Asset Investment Corp., a NYSE listed investment company.

Mikel D. Faulkner was appointed to the Board of Directors in 2009. Since 2002,2009 and has served as the lead independent director since October 2017. From February 2017 to February 2019, Mr. Faulkner has served as executive chairman of the board of directors of Nautilus Marine Services PLC, an investment company focused on the global offshore services industry and quoted on the London Stock Exchange (AIM). From 2002 to February 2017, Mr. Faulkner served as executive chairman of the board of directors of Global Energy Development PLC, aan international oil and gas exploration company, quoted company on the London Stock Exchange (AIM). He has alsoMr. Faulkner served as chief executive officer of HKN, Inc. (OTCQB: HKNI) sincefrom 1982 to 2017, chairman from 1991 to 2003 and president and chief executive officer of HKN, Inc. since 2003.from 2003 to 2017. HKN, Inc., formerly Harken Energy Corporation, iswas an independent energy company.

James H. Graves has served as a director of FirstCash since the Merger in 2016 and previously served as a Cash America director since 1996. Mr. Graves has served as managing director and partner of Erwin, Graves & Associates, LP, a management consulting firm located in Dallas, Texas, since January 2001. Mr. Graves also served as executive vice president of Financial Strategyfinancial strategy for DeviceFidelity, Inc., a financial services technology company, from March 2008 through September 2012. Mr. Graves served as a director, vice chairmanvice-chairman of the board of directors and chief operating officer of Detwiler, Mitchell & Co., a Boston-based securities research firm, from June 2002 until June 2006. Prior to that, Mr. Graves held various positions, including chief operating officer, with J.C. Bradford & Company, a

Nashville-based securities firm. He also worked for Dean Witter Reynolds, Inc. as the head of the energy group and later as head of the industry investment banking groups in New York. Mr. Graves currently serves as a director at Hallmark Financial Services, Inc. where he has served, a publicly traded insurance company, serving since 1995, Atlantic Capital Bancshares, Inc., a publicly traded bank holding company, serving since 2017 and he previously served as a director of Tristate Capital Holdings, Inc., a publicly traded bank holding company, from 2011 through July 2015. Mr. Graves also serves as a director of various privately-held companies, including a private equity fund and a healthcare technology company.

Ambassador Jorge Montaño has served as a director of FirstCash since June of 2016 and previously served as a director of the Company from June 2010 to July 2013. He is a native and resident of Mexico, where he has served in a variety of senior diplomatic positions and business consulting roles. Amb. Montaño currently serves as partner in a Mexico-based public relations and communications firm, Guerra Castellanos y Asociados. During his extensive diplomatic career, he most recently served as the Permanent Representative of Mexico to the United Nations from July 2013 until January 2016. Mr. Montaño was Ambassador to the United States from 1993 to 1995, and had a previous posting as Permanent Representative of Mexico to the United Nations from 1989 to 1992. Between 1982 and 1988, he was Senior Director of Multilateral Affairs in the Ministry of Foreign Affairs. He previously served as Director General for United Nations Specialized Organizations from 1979, the year in which he joined the Foreign Service, until 1982. From 1996 to 2013, he was President of Asesoria y Analisis, a Mexico-based consulting and lobbying firm. In addition, he has served as a professor of International Organizations at the Instituto Tecnológico Autónoma de México from 1996 to 2013.

Randel G. Owen was appointed to the Board of Directors in 2009. In March 2018, Mr. Owen has servedwas named president and chief executive officer of Global Medical Response. From July 1999 to March 2018, he previously held roles as the president of Ambulatory Services for Envision Healthcare Corporation (NYSE: EVHC) since December 2016, the effective date of the merger of Envision Healthcare Holdings, Inc. and AMSURG Corp. Prior to December 2016, Mr. Owen has served as theambulatory services, chief financial officer and executive vice president of Envision Healthcare Holdings, Inc. since May 2011Corporation (and its predecessor companies including AMR and the chief operating officer since September 2012.EmCare). He served aswas appointed executive vice president and chief financial officer since February 2005of AMR in March 2003. He joined EmCare in July 1999 and served as executive vice president since December 2005and chief financial officer from June 2001 to March 2003. Before joining EmCare, Mr. Owen was vice president of EVHC and held other senior executive andGroup Financial Operations for PhyCor, Inc. from 1995 to 1999. Mr. Owen has more than 30 years of financial positions with its predecessor companies since 2001.experience in the health care industry.

There are no family relationships between any director or executive officers.

Director Terms

The sevensix directors are divided into three classes. At each annual meeting of stockholders, one class is elected to hold office for a term of three years. Directors serve until the earlier of (i) his or hertheir death, resignation, retirement, removal or disqualification, or (ii) until his or hertheir successor is elected and qualified. The directors standing for election at this year’s annual meetingthe Annual Meeting are Messrs. Daniel E. Berce, Mikel D. Faulkner and Randel G. Owen. Messrs. Rick L. Wessel and James H. Graves will next stand for election in 2018 and2021. Mr. Daniel R. Feehan and Amb. Jorge Montaño will next stand for election in 2019.2022.

Required Vote

Proxies will be voted for the election of Messrs. Daniel E. Berce, FalknerMikel D. Faulkner and Randel G. Owen as directors of the Company unless otherwise specified in the proxy. A plurality of the votes cast by the holders of shares of Common Stock present in person or represented by proxy at the Annual Meeting will be necessary to elect the nominees as directors. If, for any reason, any nominee is unable or unwilling to serve, the proxies will be voted for a substitute nominee who will be designated by the Board of Directors at the Annual Meeting. Stockholders may abstain from voting by marking the appropriate boxes on the accompanying proxy. Abstentions will be counted separately and used for purposes of calculating whether a quorum is present at the Annual Meeting. The Company has adopted a voting policy for non-contested director elections, which is described below in the “Corporate Governance and Board Matters” section.

Recommendation of the Board of Directors

Based on the respective nominees’ experience, the Nominating and Corporate Governance Committee of the Board of Directors and the entire Board of Directors unanimously recommends a vote “FOR” the election of Messrs. Daniel E. Berce, Mikel D. Faulkner and Randel G. Owen as directors of the Company.

CORPORATE GOVERNANCE, BOARD MATTERS AND DIRECTOR COMPENSATION

Corporate Governance Enhancements

During 2016, the Company initiated a number of significant enhancements to its corporate governance structure and policies which included the following:

Increased the number of total directors from four to seven

Increased the number of independent directors from three to five

Split the roles of chairman of the board and chief executive officer

Implemented robust stock ownership guidelines for directors

Introduced restricted stock grants as an element of director compensation to better align directors’ interests with stockholders

Engaged a new independent accounting firm for the audit of the Company’s December 31, 2016 financial statements which represented a rotation to a national independent accounting firm that has not previously audited the Company or Cash America

Adopted corporate governance guidelines

Revised and adopted a new Code of Ethics

Revised and adopted new charters for all of the Board Committees

Revised and adopted a new insider trading policy

Engaged an independent compensation consulting firm to reassess and advise the Compensation Committee and Board of Directors on the following matters in light of the Merger:

| |

◦ | Peer group composition for purposes of officer and director compensation benchmarking |

| |

◦ | Review and modification of senior executive compensation plans and contractual severance provisions |

| |

◦ | Review and modification of director compensation |

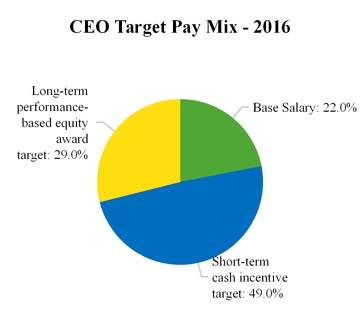

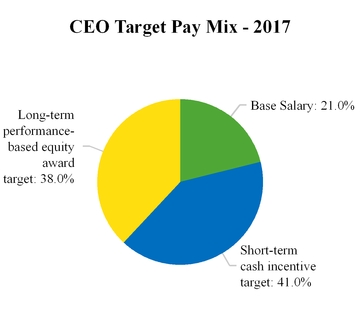

Made significant modifications to the structure of the Company’s annual performance incentive plan and long term performance incentive plan which:

| |

◦ | Increase the weighting on the long-term equity compensation elements |

| |

◦ | Reduce the amount and percentage of pay from short-term cash incentive awards |

| |

◦ | Better align the long- and short-term performance goals under these plans |

Adopted new employment agreements for our top three senior executives designed to reflect “best practices” in corporate governance and executive compensation. For the Company’s CEO, this included:

| |

◦ | The elimination of excise tax gross-ups |

| |

◦ | A reduction in the maximum payout potential for annual incentive awards |

| |

◦ | A double trigger for equity vesting in the event of a change in control |

These enhancements are more fully described in the applicable sections below.

Board of Directors, Committees and Meetings

As of January 1, 2016, the Board of Directors was composed of Messrs. Rick L. Wessel, Mikel D. Faulkner, Gabriel Guerra Castellanos and Randel G. Owen. At the annual meeting on June 6, 2016, the stockholders elected Amb. Montaño as a new director to fill the seat previously held by Mr. Guerra, who did not stand for re-election. Amb. Montaño previously served on the Board of Directors of the Company from June 2010 to July 2013. Concurrent with the closing of the Merger on September 1, 2016, the size of the Board of Directors was increased from four directors to seven directors and Messrs. Feehan, Berce and Graves, three of the seven former directors of Cash America, were added to the Board of Directors.

The Board of Directors held eightfour meetings during the year ended December 31, 2016. All of the directors each2019. Each director attended, either telephonically or in person, at least 75% of the meetings of the Board of Directors during their respective terms, exceptwith the exception of Amb. Montaño who did not attend one of the meetings held during his term as director during 2016 due to an illness.meetings. Members of the Board of Directors are encouraged to attend the Company’s annual meeting;Annual Meeting; however, attendance is not mandatory. Mr.Messrs. Wessel and Feehan attended last year’s Annual Meeting. In addition, the independent directors of the Company meet separately in executive sessions after regularly scheduled meetings of the Board of Directors and more frequently as deemed appropriate by the independent directors.

During 2016 through the date of the annual meeting on June 6, 2016, the Audit, Compensation and Nominating and Corporate Governance Committees each consisted of Mr. Faulkner, Mr. Guerra and Mr. Owen. From June 6, 2016 through Septemberperiod from January 1, 2016,2019 to April 22, 2019, the committees each consisted of Mr. Faulkner, Amb. Montaño and Mr. Owen. After the Merger, and as of today, the committees arewere composed as follows:

| | | Independent Director | | Audit | | Compensation | | Nominating and Corporate Governance | | Audit | | Compensation | | Nominating and Corporate Governance |

| Mikel D. Faulkner (Lead Independent Director) | | | | | l | | Chair |

| Daniel E. Berce | | ü | | ü | | Chair | | l |

| Mikel D. Faulkner | | ü | | ü | |

| James H. Graves | | ü | | ü | | | l | | l | |

| Jorge Montaño | | ü | | l |

| Randel G. Owen | | ü | | ü | | | l | | Chair | |

| | | |

| Meetings Held in 2016 | | 7 | | 4 | | 2 | |

| Meetings held January 1, 2019 to April 22, 2019 | | | 1 | | 2 | | None |

AllEffective April 23, 2019, in connection with Amb. Montaño’s retirement from the Board of Directors, Messrs. Berce, Faulkner, Graves and Owen were appointed as members of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The chair of each committee members eachremained the same.

During the period from April 23, 2019 to December 31, 2019, the committees were composed as follows:

|

| | | | | | |

| Independent Director | | Audit | | Compensation | | Nominating and Corporate Governance |

| Mikel D. Faulkner (Lead Independent Director) | | l | | l | | Chair |

| Daniel E. Berce | | Chair | | l | | l |

| James H. Graves | | l | | l | | l |

| Randel G. Owen | | l | | Chair | | l |

| | | | | | | |

| Meetings held April 23, 2019 to December 31, 2019 | | 3 | | 2 | | 1 |

Each committee member attended, either telephonically or in person, at least 75% of the meetings of their respective meetings of the committees during their respective terms, except that Amb. Montaño2019, with the exception of Mr. Owen who did not attend one of the Audit Committee meetings held in 2019.

Effective January 1, 2020, Mr. Graves became the chair of the Nominating and Corporate Governance meeting held during the time he was a member due to an illness.Committee.

Mr. Feehan currently serves as non-executive Chairman of the Board of Directors of the Company as provided under the terms of the employment agreement he entered into with Cash America prior to the Merger. For a description of Mr. Feehan’s current employment agreement, see the discussion under “Directors’ Compensation.”

Board Committees

Audit Committee. The Audit Committee is responsible for the oversight of the Company’s accounting and financial reporting processes. This includes the selection and engagement of the Company’s independent registered public accounting firm and review of the scope of the annual audit, audit fees and results of the audit. The Audit Committee reviews and discusses with management and the Board of Directors such matters as accounting policies, internal accounting controls, procedures for preparation of financial statements and other financial disclosures, scope of the audit, the audit plan and the independence of such accountants. In addition, the Audit Committee has oversight over the Company’s internal audit function.and regulatory compliance functions. The Board of Directors has determined that Messrs. Berce, Graves and Owen areall members of the Audit Committee qualify as an audit committee financial expertsexpert as defined by Item 401(h) of Regulation S-K promulgated under the Securities Act of 1933, as amended (“Securities Act”), and the Securities Exchange Act of 1934, as amended (“Exchange Act”), and each member of the Audit Committee is independent under the listing standards of the NYSE.. The Board of Directors has adopted a charter for the Audit Committee which is available to stockholders as described below.

Compensation Committee. The Compensation Committee is responsible for reviewing and approving corporate goals and objectives relevant to the compensation of the Company’s CEO, evaluating the CEO’s performance in light of those goals and objectives, and recommending to the Board of Directors for approval of the CEO’s compensation. The Compensation Committee is also responsible for recommending to the Board of Directors for approval the compensation of all other executive officers of the Company. In addition, the Compensation Committee oversees and approves grants and awards under the Company’s equity-based plans, incentive compensation plans and tax-qualified employee benefit plans, and approves severance and other termination payments to executive officers.

The Board of Directors has adopted a charter for the Compensation Committee which is available to stockholders as described below. Pursuant to its charter, the Compensation Committee may delegate all or a portion of its duties and responsibilities to one or more subcommittees consisting of one or more of its members. For more information regarding the Compensation Committee’s process and procedures for consideration of executive compensation, see “Compensation Discussion and Analysis.”

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for making recommendations to the Board of Directors concerning the governance structure and practices of the Company, including the size of the Board of Directors and the size and composition of various committees of the Board of Directors. In addition, the Nominating and Corporate Governance Committee is responsible for identifying individuals believed to be qualified to become directors, and to recommend to the Board of Directors the nominees to stand for election as directors at the Annual Meeting of Stockholders. The Board of Directors has adopted a charter for the Nominating and Corporate Governance Committee, which was revised in April 2020. The charter is available to stockholders as described below.

The Board of Directors has determined that each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee is independent under the listing standards of Nasdaq, the SEC rules and the Company’s Corporate Governance Guidelines. Each of the Company’s committee charters is publicly available and can be accessed on the Investor Relations page of the Company’s website at www.firstcash.cominvestors.firstcash.com. Copies of the Company’s committee charters are also available, free of charge, by submitting a written request to FirstCash, Inc., Investor Relations,the Corporate Secretary, at 1600 West 7th Street, Fort Worth, Texas 76102.

Directors’ Compensation

20162019 Director Compensation

The Board of Directors reviews director compensation on a periodic basis. Such reviews include collecting and analyzing benchmarking information from compensation advisory firms regarding the amount and structure of the Company’s director compensation as compared to its peers. In conjunction with such review in early 2019, the Board of Directors determined the compensation for independent directors for 2019 would be structured as follows:

Annual cash compensation of $100,000, paid in quarterly installments of $25,000

A grant of 1,272 restricted stock units, valued at $110,486 on the date of grant, February 19, 2019, which fully vested on December 31, 2019

Supplemental annual cash payments of $20,000 to the Audit Committee chairman, $15,000 to the Compensation Committee chairman and $10,000 to the Nominating and Corporate Governance Committee chairman. All amounts are paid in quarterly installments.

The Board of Directors believes the mix of cash and equity compensation provides a balance between short-term cash compensation and long-term compensation tied to the Company’s stock price performance and serves to match the interests of the Company’s independent directors with those of stockholders. Based upon benchmark data of the Company’s 2019 Peer Group (as discussed in the “Compensation Discussions and Analysis”), the Board also believes the total director compensation and the mix of compensation is within the competitive range of such compensation for the companies in the 2019 Peer Group.

For the year ended December 31, 2016,2019, the independent directors received compensation for service as a director andas described above. There are no supplemental payments for attending the meetings of the Board of Directors and committee meetings. The legacy First Cash directors were paid in quarterly cash installments of $37,500 for each quarter of service. There were no stock awards or supplemental payments for committee chairs or meeting fees. In addition, the directors were reimbursed for their reasonable expenses incurred for each Board of Directors and committee meetings attended. The Company only compensates independent non-employee directors for their services as directors. The compensation paid to Mr. Wessel is described in the “Compensation Discussion and Analysis” section of this proxy statement.Proxy Statement. The following table presents information regarding the compensation paid to the non-employee members of the Company’s Board of Directors, and to Mr. Feehan, for the year ended December 31, 2016:2019:

| | | Name | | Fees Earned or Paid in Cash $ | | Stock Awards $ | | All Other Compensation | | Total $ | | Fees Earned or Paid in Cash $ | | Stock Awards $ | | All Other Compensation $ | | Total $ |

Daniel E. Berce (1) | | 13,625 |

| | — |

| | — |

| | 13,625 |

| | 120,000 |

| | 110,486 |

| | — |

| | 230,486 |

|

| Mikel D. Faulkner | | 150,000 |

| | — |

| | — |

| | 150,000 |

| | 110,000 |

| | 110,486 |

| | — |

| | 220,486 |

|

Daniel R. Feehan (2)(1) | | — |

| | — |

| | 125,000 |

| | 125,000 |

| | — |

| | — |

| | 250,000 |

| | 250,000 |

|

James H. Graves (1) | | 13,250 |

| | — |

| | — |

| | 13,250 |

| | 100,000 |

| | 110,486 |

| | — |

| | 210,486 |

|

| Gabriel Guerra Castellanos (3) | | 75,000 |

| | — |

| | — |

| | 75,000 |

| |

| Jorge Montaño (4) | | 84,500 |

| | — |

| | — |

| | 84,500 |

| |

| Jorge Montaño | | | 45,000 |

| | — |

| | — |

| | 45,000 |

|

| Randel G. Owen | | 150,000 |

| | — |

| | — |

| | 150,000 |

| | 115,000 |

| | 110,486 |

| | — |

| | 225,486 |

|

| |

(1) | Messrs. Berce and Graves became directors effective September 1, 2016. They were compensated for service for the fourth quarter of 2016 for the merged Company under the compensation formula previously used by Cash America. Effective January 1, 2017, their compensation has been conformed to the new compensation structure for all independent directors as outlined below. |

| |

(2) | Mr. Feehan who served as the Executive Chairman of the Board of Cash America at the time of the Merger, currently serves as the Chairmanchairman of the Board of Directors of the Company following the Merger.Company. Mr. Feehan also served as a non-executive employee of Cash America pursuant to an Employment Agreement dated April 3, 2015 (the “Feehan Employment Agreement”). In connection with the Merger, the Company assumed the Feehan Employment Agreement, and Mr. Feehan currently servesin 2019 as a non-executive employee of the Company pursuant to an employment agreement dated April 3, 2015, which the terms ofCompany assumed in connection with the Feehan Employment Agreement.Merger. For a description of the Feehan Employment Agreement,Mr. Feehan’s employment agreement, see Cash America’s proxy statement on Schedule 14A filed with the SEC on April 7, 2016. The Feehan Employment AgreementMr. Feehan’s employment agreement is filed as Exhibit 10.1 to Cash America’s Current Report on Form 8-K filed with the SEC on April 6, 2015. The compensation reported represents his salary fromduring the period September 1, 2016 throughyear ended December 31, 2016.2019. In addition, the Company paid for certain standard employee benefit programs for Mr. Feehan, including participation in group health, welfare and retirement benefit plans. |

| |

(3) | plans, which are generally available to all employees. Mr. Guerra servedFeehan and the Company entered into a new employment agreement dated January 28, 2020, which is filed as Exhibit 10.16 to the Company’s Annual Report on Form 10-K filed with the SEC on February 3, 2020. For a director until the annual meeting on June 6, 2016, when he did not stand for re-election. His compensation represents service for the first and second quartersdescription of 2016. |

| |

(4) | Amb. Montaño became a director effective June 6, 2016. His compensation represents service for the period from June 6, 2016 to December 31, 2016.Mr. Feehan’s current employment agreement, see “Feehan Employment Agreement” below. |

2017 Directors CompensationFeehan Employment Agreement

In conjunction withOn January 28, 2020, the merger,Company’s chairman of the Board of Directors, engagedMr. Feehan, entered into a new employment agreement with the Company (the “Feehan Agreement”). Mr. Feehan’s previous employment agreement with the Company was set to expire in April 2020. The Feehan Agreement became effective as of January 1, 2020 and ends on December 31, 2023. The Company will pay to Mr. Feehan an independent consulting firm, Pay Governance,annual salary of $300,000, paid biweekly, and provides him the right to benchmark the compensationparticipate in all of the independent directors againstCompany’s savings, retirement and welfare benefit plans available to other employees of the Company. Mr. Feehan is not entitled to bonuses, equity grants or other director compensation under this agreement.

The agreement provides that if Mr. Feehan’s employment with the Company is terminated during the term by the Company without “cause” or by the executive for “good reason” (as such terms are defined in the employment agreement), Mr. Feehan would be entitled to a lump sum cash severance payment equal to one times (or two times, if such termination occurs within twelve months following a change in control of

directorsthe Company) his salary in effect as of the termination. He would also be entitled to continue to participate in the Company’s

2017 peer group as discussedhealth and welfare benefit plans at active employee rates for a period of eighteen months (the “COBRA subsidy”). Furthermore, if such termination occurs within twelve months following a change in

control of the

“Compensation Discussion and Analysis.” Pay Governance reviewedCompany, the structure of director compensation as it relates to total compensation and the mix or elements of compensation. Based on the input from Pay Governance and review of other benchmarking information, the Board determined that the compensation for independent directors beginning in 2017 would be structured as follows:

Annual cash compensation of $90,000, paid in quarterly installments of $22,500

Annual grants of restricted stock units valued at $90,000 vesting monthly over the annual service period

Supplemental annual cash payments of $20,000Company will pay to the Audit Committee chairman, $15,000executive, in lieu of the COBRA subsidy described above, a lump sum in cash in an amount equal to the Compensation Committee chairmanfull monthly cost of health and $10,000 to the Nominating and Corporate Governance Committee chairman. All amounts are paid in quarterly installments.welfare benefit coverage multiplied by 24.

The BoardFeehan Agreement prohibits Mr. Feehan from competing with the Company during the employment term and for a period of Directors believes the mix24 months following termination of cashemployment. Mr. Feehan would also be prohibited from soliciting Company customers and equity compensation provides a balance between short-term cash compensation and longer term compensation tied to the Company’s stock price performance and serves to better match the interests of the Company’s independent directors with those of stockholders. Based upon benchmark data provided by Pay Governance, the Board also believes the total director compensation and the mix of compensation is within the competitive range of such compensation for the companies in the peer group.recruiting Company employees during this period.

Code of Business Conduct and Ethics

During 2016, the Company revised and adopted a newThe Code of Ethics that applies to all of its directors, officers,Business Conduct and key employees. The Company intends to disclose future amendments to, or waivers from, provisions of its Code of Ethics on its website in accordance with applicable NYSE and the SEC requirements. The Code of Ethics is publicly available and can be accessed on the Company’s website at www.firstcash.comwww.firstcash.com..The Company intends to disclose future amendments to, or waivers from, certain provisions of its Code of Business Conduct and Ethics on its website in accordance with applicable Nasdaq and SEC requirements. Copies of the Company’s Code of Business Conduct and Ethics are also available, free of charge, by submitting a written request to FirstCash, Inc., Investor Relations, 1600 West 7th Street, Fort Worth, Texas 76102.

Stock Ownership Guidelines for Directors

In October 2016,an effort to further align the interests of the directors with the interests of stockholders, the Company adopted a stock ownership guideline for non-employee directors.directors which became effective beginning in 2017. The guidelines call for stock ownership (including the value of non-vested RSU’s) having a value equal to five times each director’s annual cash retainer with a five-year graceaccumulation period to fully comply with the new guideline once a director becomes subject to the guideline. As of April 13, 2020, two of the four independent directors met the new ownership guideline, while the other two continued to have until 2021 to meet the guidelines. Directors who have not met the guideline must retain their vested stock awards until they meet the guideline. While the guidelines do not apply to employee directors, the current stock ownership of the two employee directors would meet the guidelines if calculated at five times their annual salary as an employee of the Company.

Director Election (Majority Voting) Policy

The Company has adopted a Director Election (Majority Voting) Policy. Pursuant to this policy, in an uncontested election of directors (that is, an election where the number of nominees is equal to the number of seats open) any nominee for director who receives a greater number of “WITHHOLD” votes than “FOR” votes for his election must promptly submit an offer of resignation to the Nominating and Corporate Governance Committee following the certification of the stockholder vote for consideration in accordance with the following procedures.

The Nominating and Corporate Governance Committee will consider any tendered resignation and, promptly following the date of the stockholders’ meeting at which the election occurred, will make a recommendation to the Board of Directors concerning the acceptance or rejection of such resignation. In determining its recommendation to the Board of Directors, the Nominating and Corporate Governance Committee will consider all factors deemed relevant by the members of the Nominating and Corporate Governance Committee including, without limitation, the stated reason or reasons why stockholders who cast “withhold” votes for the director did so, the qualifications of the director (including, for example, the impact the director’s resignation would have on the Company’s compliance with the requirements of the SEC and the rules of the NYSE)Nasdaq), and whether the director’s resignation from the Board of Directors would be in the best interests of the Company and its stockholders.

The Nominating and Corporate Governance Committee also will consider a range of possible alternatives concerning the director’s tendered resignation as members of the committee deem appropriate, including, without limitation, acceptance of the resignation, rejection of the resignation, or rejection of the resignation coupled with a commitment to seek to address and cure the underlying reasons reasonably believed by the Nominating and Corporate Governance Committee to have substantially resulted in the “withheld” votes.

The Board of Directors will publicly disclose its decision regarding whether to accept or reject such resignation within 90 days following certification of the stockholder vote and shall disclose the reasons therefore. The Director Election (Majority Voting) Policy is publicly available and can be accessed on the Investor Relations page of the Company’s website at investors.firstcash.com

Director Independence

The Board of Directors has determined that, with the exception of Mr.Messrs. Wessel and Mr. Feehan, all of its directors, including all of the members of the Audit, Compensation, and Nominating and Corporate Governance Committees, are “independent” as defined by the NYSE andNasdaq, the SEC and for purposes of Section 162(m) of the Code.Company’s Corporate Governance Guidelines. No director is deemed independent unless the Board of Directors affirmatively determines the director has no material relationship with the Company. In making its determination, the Board of Directors observes all criteria for independence established by the rules of the SEC and the NYSE.Nasdaq.

Oversight of Risk Management

The Board of Directors is responsible for overseeing and monitoring the material risks facing the Company. In its oversight role, the Board of Directors regularly reviews the Company’s strategic initiatives, which address, among other things, the risks and opportunities facing the Company. The Board of Directors also has overall responsibility for executive officer succession planning and reviews succession plans from time to time. The Board of Directors has delegated certain risk management oversight responsibility to its committees. As part of its responsibilities set forth in its charter, the Audit Committee is responsible for discussing with management the Company’s major financial risk exposures, including financial risks and cybersecurity, and the steps management has taken to monitor and control those exposures, including the Company’s risk assessment and risk management policies.

The Compensation Committee reviews the risks and rewards associated with the Company’s compensation programs. With the assistance of an independent compensation consulting firm, the Compensation Committee designs compensation programs with features that mitigate risk without diminishing the incentive nature of the compensation. While these performance-based compensation and equity programs have been designed and administered in a manner that discourages undue risk-taking by employees, the Compensation Committee believes these programs create appropriate incentives to increase long-term stockholder value. The Compensation Committee has discussed the concept of risk as it relates to the compensation programs and the Compensation Committee does not believe the compensation programs encourage excessive or inappropriate risk taking for the following reasons:

The Company structures its pay to consist of both fixed and variable compensation. The fixed portion of compensation (salary) is designed to provide a steady income independent of the Company’s stock price performance so that executives do not feel pressured to focus exclusively on short-term stock price performance to the long-term detriment of other important business decisions and metrics and are not encouraged to take unnecessary or excessive risks to achieve corporate objectives. The variable portions of compensation (incentive-based cash and equity awards) are designed to reward both short- and long-term corporate performance. For short-term performance, the Company utilizes annual incentive-based cash awards that are based primarily on achieving a combination of earnings metrics and strategic directives, such as store addition targets.directives. The metrics and directives are set annually by the Compensation Committee and approved by the Board of Directors. For long-term performance, the Company grants restricted stock awards with a multi-year vesting period tied to the achievement of long-term earnings, revenue and store growth targets. The Company believes these variable elements of compensation are a sufficient percentage of overall compensation to motivate executives to produce both superior short- and long-term corporate results.

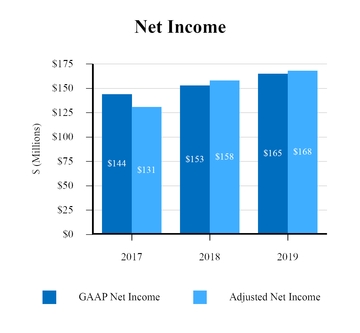

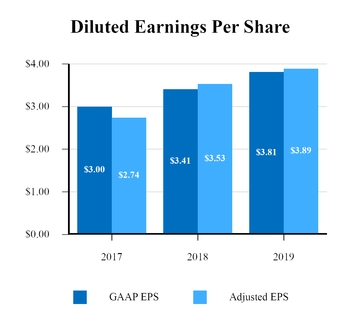

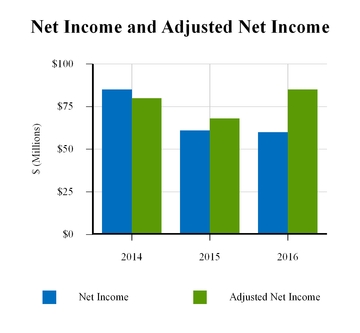

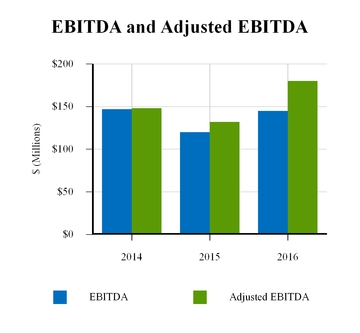

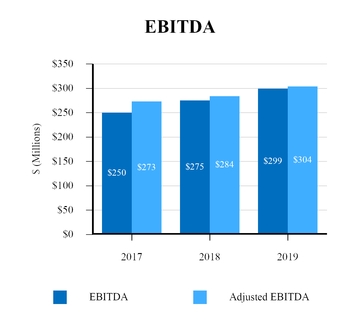

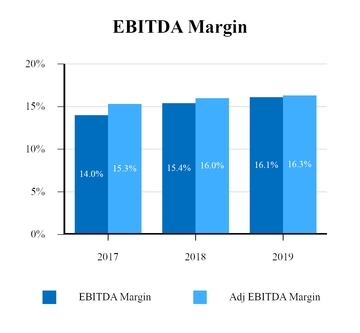

Because earnings targets, such as adjusted EBITDA, adjusted net income and adjusted diluted earnings per share, are significantthe primary performance elements used for determining incentive payments, the Company believes its executives are encouraged to take a balanced approach that focuses on corporate profitability, rather than other measures which may incite management to drive sales or growth targets without regard to cost or profitability.

The Company caps cash payments for the goals under its annual incentive plan and caps the number of restricted stock units granted under its long-term incentive plan, which the Company believes also mitigates excessive risk taking. Even if the Company dramatically exceeds its targets, annual incentive payouts and stock grants are limited by such caps. Conversely, the Company has a floor on earnings and growth targets so that performance below a certain level (as approved by the Compensation Committee) does not result in annual incentive payouts or vesting of stock grants.

The Company’s incentive compensation programs have been structured primarily around the attainment of earnings and growth targets for many years and the Company has seen no evidence that this encourages unnecessary or excessive risk taking.

The Company believes the use of distinct long-term incentive plans, primarily restricted stock unit awards, with performance-based vesting over a number ofthree years, provides a strong incentive for sustained operational and financial performance and aligns the interests of our namedthe Company’s executive officers with those of ourits stockholders.

The Compensation Committee has discretion to adjust payouts under both the annual and long-term performance plans to reflect the core operating performance of the business, but prohibits discretion for payouts above stated maximum awards.

Board Leadership Structure

Effective September 1, 2016 and in connection with the Merger, Mr. Feehan was appointedserves as chairman of the board,Board of Directors, while Mr. Wessel continued to serveserves in the role of CEO and is also the vice-chairman of the board. The Company does not have aBoard of Directors. In addition, Mr. Faulkner serves as the lead independent director.director, serving as a liaison between the independent directors and management, chairing executive sessions of the non-management and independent directors and consulting with the chairman and CEO on board agendas and meeting materials.

The Board of Directors recognizes that the leadership structure and combination or separation of the CEOchairman, lead independent director and chairmanCEO roles is driven by the needs of the Company at any point in time. The Board of Directors does not believe there should be a fixed rule as to whether the offices of chairman and CEO should be vested in the same person or two different people, or whether the chairman should be an employee of the Company or should be elected from among the non-employee directors. The needs of the Company and

the individuals available to fulfill these roles may dictate different outcomes at different times, and the Board of Directors believes that retaining flexibility in these decisions is in the best interest of the Company and its stockholders.

Director Qualifications

At a minimum, candidates for election or appointment to the Board of Directors must have integrity, be committed to act in the best interest of all the Company’s stockholders and be able and willing to devote the required amount of time to the Company’s affairs, including attendance at meetings of the Board of Directors. In recommending candidates, the Nominating and Corporate Governance Committee takes into consideration any criteria approved by the Board and such other factors as it deems appropriate, including, among other things, the candidate’s judgment, skill, diversity, and experience with business and other organizations of comparable size. The Nominating and Corporate Governance Committee endeavors to evaluate, propose and approve candidates, including those recommended by stockholders, with business experience and personal skills in finance, marketing, financial reporting and other areas that may be expected to contribute to an effective Board of Directors. The Nominating and Corporate Governance Committee seeks to assure that the Board of Directors is composed of individuals who have experience relevant to the needs of the Company and who have the highest professional and personal ethics, consistent with the Company’s values and standards. Candidates should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Each director must represent the interests of all stockholders.

In recommending candidates, the Nominating and Corporate Governance Committee takes into consideration any criteria approved by the Board of Directors and such other factors as it deems appropriate, including:

The extent of the director’s/potential director’s educational, business, non-profit or professional acumen and experience;

Whether the director/potential director assists in achieving a mix of board members that represents a diversity of background, perspective and experience, including with respect to age, gender, race, place of residence and specialized experience;

Whether the director/potential director meets the independence requirements established by Nasdaq, the SEC and the Company’s Corporate Governance Guidelines;

Whether the director/potential director has the financial acumen or other professional, educational or business experience relevant to an understanding of the Company’s business;

Whether the director/potential director would be considered a “financial expert” or “financially sophisticated” as defined by Nasdaq or applicable law;

Whether the director/potential director, by virtue of particular technical expertise, experience or specialized skill relevant to the Company’s current or future business, will add specific value as a board member; and

Whether the director/potential director possesses a willingness to challenge and stimulate management and the ability to work as part of a team in an environment of trust.

The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. In addition to the criteria set forth above, the Nominating and Corporate Governance Committee considers how the skills and attributes of each individual candidate or incumbent director work together to create a board that is collegial, engaged and effective in performing its duties.

The Company’s Board of Directors is currently composed of well qualified directors, and each director has the requisite experience, skills and characteristics to serve on the board. Among, or in addition to, the backgrounds and experiences described in “Proposal 1 - Election of Directors” of this Proxy Statement:

Mr. Feehan, the Company’s chairman, brings over 35 years of experience as a director, chief executive officer and chief financial officer with Cash America and a deep understanding of the pawn industry and the legacy Cash America business.

Mr. Wessel, the Company’s vice-chairman and chief executive officer, brings over 25 years of management and executive experience in the pawn industry gained from his roles as chief financial officer, chief executive officer and director of the Company. His deep understanding of the Company’s business and his success in expanding its business has been invaluable to the Board of Directors.

Mr. Berce brings broad senior executive leadership with significant experience in the consumer finance industry, and functional expertise in corporate finance and accounting, together with service on other public company boards of directors, including Cash America.

Mr. Faulkner brings broad senior executive leadership and financial experience, including with domestic and multi-national public and private companies in various industries. Mr. Faulkner’s qualifications include direct executive experience in Latin America, our primary growth market.

Mr. Graves brings significant experience in corporate strategy and finance gained from his experience as the managing partner of a management consulting firm and a financial strategy executive, together with meaningful service on the boards of other public companies, including Cash America.

Mr. Owen brings broad senior executive leadership and financial experience with private and public companies, and functional expertise in corporate finance and accounting.

Although there is no specific policy on considering diversity, the Board of Directors and the Nominating and Corporate Governance Committee take various diversity-related considerations into account in the selection criteria for new directors. The Nominating and Corporate Governance Committee seeks members from diverse professional and personal backgrounds to combine a broad spectrum of experience and expertise with a reputation for integrity. Some additional considerations may include national origin,The Board considers gender, race, functional backgroundnationality, language skills and other personal characteristics in this process and the diversity of perspectives thatextent to which the candidate would bring toprospective nominee helps the Board of Directors.Directors reflect the gender, racial, ethnic and global diversity of the Company’s stockholders, employees and customers. In this regard, the Board and the Nominating and Corporate Governance Committee are committed to including highly qualified women and individuals from minority groups in the pool of new candidates for membership.

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee will utilize a variety of methods for identifying and evaluating nominees for director. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current members of the Board of Directors, professional search firms, stockholders or other persons. These candidates will be evaluated at regular or special meetings of the Nominating and Corporate Governance Committee, and may be considered at any point during the year. The Nominating and Corporate Governance Committee will also consider properly submitted stockholder nominations for candidates for the Board of Directors. The procedures to be followed by stockholders in submitting such nominations are set forth in the “Stockholder Proposals” section. Following verification of the stockholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating and Corporate Governance Committee. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials will be forwarded to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may also review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder.

Procedure for StockholderStockholders and Interested Parties Communications with Directors